Strategic Mortgage Financing.

by Mike Havery, AMP

Mortgage Broker & Planner

We'll ensure you get the best mortgage financing possible.

Mortgage financing can be confusing, it doesn't have to be, here's the plan.

Get started right away

The best place to start is to connect with us directly. The mortgage process is personal. Our commitment is to listen to all your needs, assess your financial situation, and provide you with a clear plan forward.

Get a clear plan

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming. Let us cut through the noise, we'll outline the best mortgage products available, with your needs in mind.

Let us handle the details

When it comes time to arranging your mortgage, we have the experience to bring it together. We'll make sure you know exactly where you stand at all times. No surprises. We've got you covered.

Mike Havery, AMP

Mortgage Broker & Planner

With all the options available on the market and no shortage of information, working through mortgage financing can seem overwhelming. My goal is to ensure you understand exactly where you stand at all times, educate you throughout the process, and help you get the best mortgage for you. I do this through strategic mortgage planning.

Instead of just looking at the different mortgage products on the market and selecting the best one, we look at your life circumstances, goals, and plans, and then select the best mortgage product to match your individual needs.

And now working with my son Matthew, our commitment is to ensure you have the best mortgage for you, for as long as you need a mortgage!

Read more about me here >>

Why Work With Us?

Our team has a passion to deliver exceptional customer service and each team member has a core function.

It takes a whole community to get you into a home and we have a wonderful team here.

Get started by completing my online mortgage application.

I'll let you know exactly where you stand so you can proceed with confidence.

Nice things clients have said about working with us.

We can help you arrange mortgage financing for the following services:

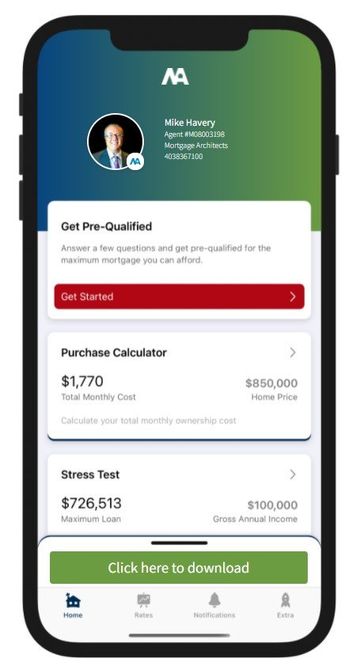

Download My Mortgage Toolbox and get access to all premium tools to help plan your mortgage

WHAT CAN YOU DO WITH MY APP

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Mortgage financing for First Time Home Buyers

Everything you need to know to buy your first home with confidence. Let us help!

Let's run some numbers.

Start by telling us where you're at in your home buying journey.

Articles to keep you learning

Send a Message

Send A Message

Thank you for contacting us.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Contact Information

Mike Havery, AMP

Mortgage Broker & Planner

Cell: 403-836-7100

Toll-Free: 1-866-250-2988

Fax: 1-866-850-1708

Mike Havery The Mortgage Architect

10672 46th Street SE, #16

Calgary, AB T2C 1G1

Mike Havery The Mortgage Architect | Mortgage Architects Lic 12728 | All Rights Reserved | Privacy and Content Notice